Összegzés

Highlights

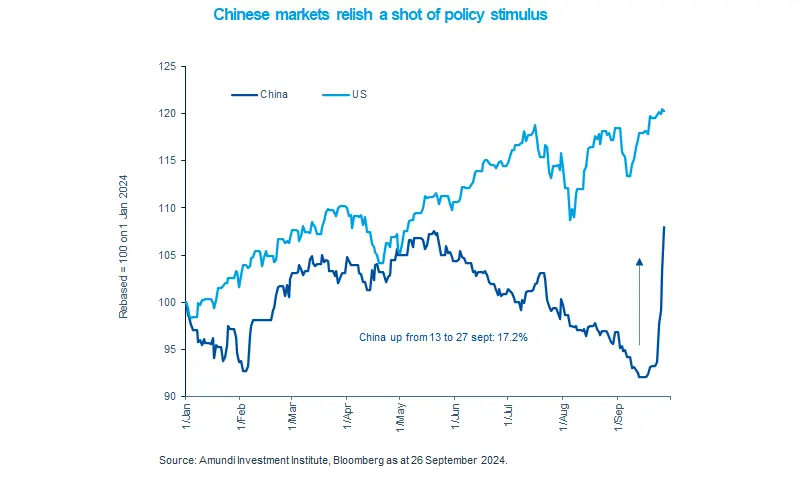

- Chinese markets rose sharply on the back of optimism around stimulus measures announced by the PBoC.

- The bank reduced its policy rates, cut the reserve requirement ratio and made it easier for people to buy second homes.

- We continue to monitor these developments with a positive bias and remain constructive on broader EM.

In this edition

Chinese stocks staged a sharp rebound followed by monetary stimulus and liquidity-boosting measures announced by the People’s Bank of China (PBoC). President Xi Jinping’s Politburo also asserted its commitment to achieve economic growth targets. Sentiment was so strong that markets erased all their losses, sending the index into positive territory. The monetary easing and slight changes to housing policy signal a renewed effort by China to support the economy. However, on their own, these measures are unlikely to reverse the structural problems. A lot depends on whether a robust government-backed stimulus package materializes. If consumer-oriented fiscal measures are introduced, we think economic growth expectations for the next year could improve. Otherwise, the market rally may be short-lived. For now, these moves have improved the sentiment.

Key dates

UK GDP, Japan retail sales, China PMI

CPI: Euro area, Indonesia

US labour markets, Mexico unemployment

Read more